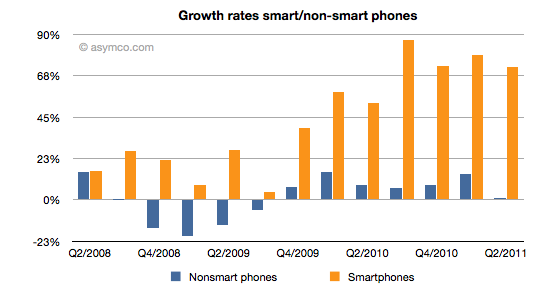

According to a @asymco tweet, on September 15:

- World-wide quarterly smartphone y/y unit growth since beginning of 2010: 59% 53% 87% 73% 79% 73%

- World-wide quarterly non-smart phone y/y unit growth since beginning of 2010: 15% 8% 6% 8% 14% 1%

The graphical visualization comes from his post Mobile Impossible

Users are moving from feature phones to smartphones. See asymco’s post for the analysis: Biggest mobile loser? The non-smart phone. Some of the conclusions on feature phones were ” Not only is it an unprofitable product for almost every vendor, it is also being increasingly shunned by buyers.”

The growth and profits seem to be in smartphones, but if we look at the smartphone players, just a few are successful and profitable.

- HP has just abandoned WebOS

- Intel is stopping the development of MeeGO (temporarily)

- Motorola has been acquired by Google

- Nokia Loses Place In European Blue Chip Index (the top 50 European stocks) because of the sharp fall in its market value in recent months.

- RIMM stocks are down 20% today after the latest earnings reports, raising the prospects that the BlackBerry maker will be sold, broken up, or at least placed under new leadership. An analysis from asymco on RIMM latest earnings report RIM and the lamentation of the analyst

- LG is considering to withdraw from the mobile device business after the continued losses

- Sony-Ericsson has losses as well and might consider an exist

- There are many other players in the smartphones space that use Android such as Huawei and Pantech that are smaller (at the moment), but very aggressive.

For a great overview of Q2 mobile phones share, see Horace Dediu’s post Apple captured two thirds of available mobile phone profits in Q2. For Q2 stats, see my older post Updates on the smartphones platform war.

And on the mobile platforms side from The fate of mobile phone brands:

Conclusions. Feature phones are not an attractive business. In the smartphones space Apple is the big winner. Competitors are mainly using Android and some use Windows Phone as well. In strategy, or you have a differentiation that you can claim a price difference for or you need to have a cost advantage. To differentiate while having a common platform is very hard. If you change and customize the platform, you increase the fragmentation with problems for the evolution of the platform and with the risk of breaking the apps, needed as a base for competition. Form factors and UI interaction are now standard, mono blocks with a touch UI paradigm. Hardware components have been commoditized: smartphones are all based on the ARM architecture. And for the rest, memory, cameras, sensors, displays are sourced from the same manufacturers and do not provide enough differentiation, at least not one that an end-user can notice and pay more for it. Different OEMs want to differentiate with exclusive services, but Internet services want scale, many users and work across platforms so their needs are not aligned with a single OEM or platform. The solution? Brand, distribution, and more importantly innovation that goes beyond of what we have now.